Are Your Drains Really Covered by Home Insurance? A Plymouth Homeowner’s Guide

Blocked or collapsed drains don’t just leave you ankle-deep in murky water, they can leave you knee-deep in surprise costs if your insurer says “sorry, that’s maintenance.” Knowing where your policy stands before the pipe cracks is half the battle.

The Good News: Accidental Damage Is Usually In

Most standard UK buildings policies include an “accidental damage to underground services” clause. That typically means:

-

Sudden, unexpected events – a tree root bursts a clay pipe, a contractor’s digger caves in the run, a winter frost splits a joint.

-

Within your boundary – you are legally responsible for the drain, not the water board.

-

Trace-and-access – many policies pay to locate the leak, dig down and reinstate drives, patios or flowerbeds.

Tick those three boxes and the insurer should pick up the tab for repairs and reinstatement.

| Not Covered | Why It’s Excluded |

|---|---|

| Long-term wear, corrosion, sags | Considered routine homeowner upkeep |

| Fatbergs, wipes, “flushable” items | Misuse or poor maintenance |

| Shared drains or pipes beyond the boundary | Water company’s responsibility |

| Poor workmanship or DIY damage | Installer error, not an insurance risk |

Home Emergency & Drainage Add-Ons—Worth It?

For a modest annual fee, a home-emergency rider can:

-

Send a qualified engineer 24 ⁄ 7 to unblock a WC or stop a leak.

-

Cover labour and materials up to a fixed call-out limit (often £500–£1,000).

But: these policies rarely pay for permanent solutions like relining a long section of pipe; they’re first aid, not surgery.

How to Stay Claim-Ready

-

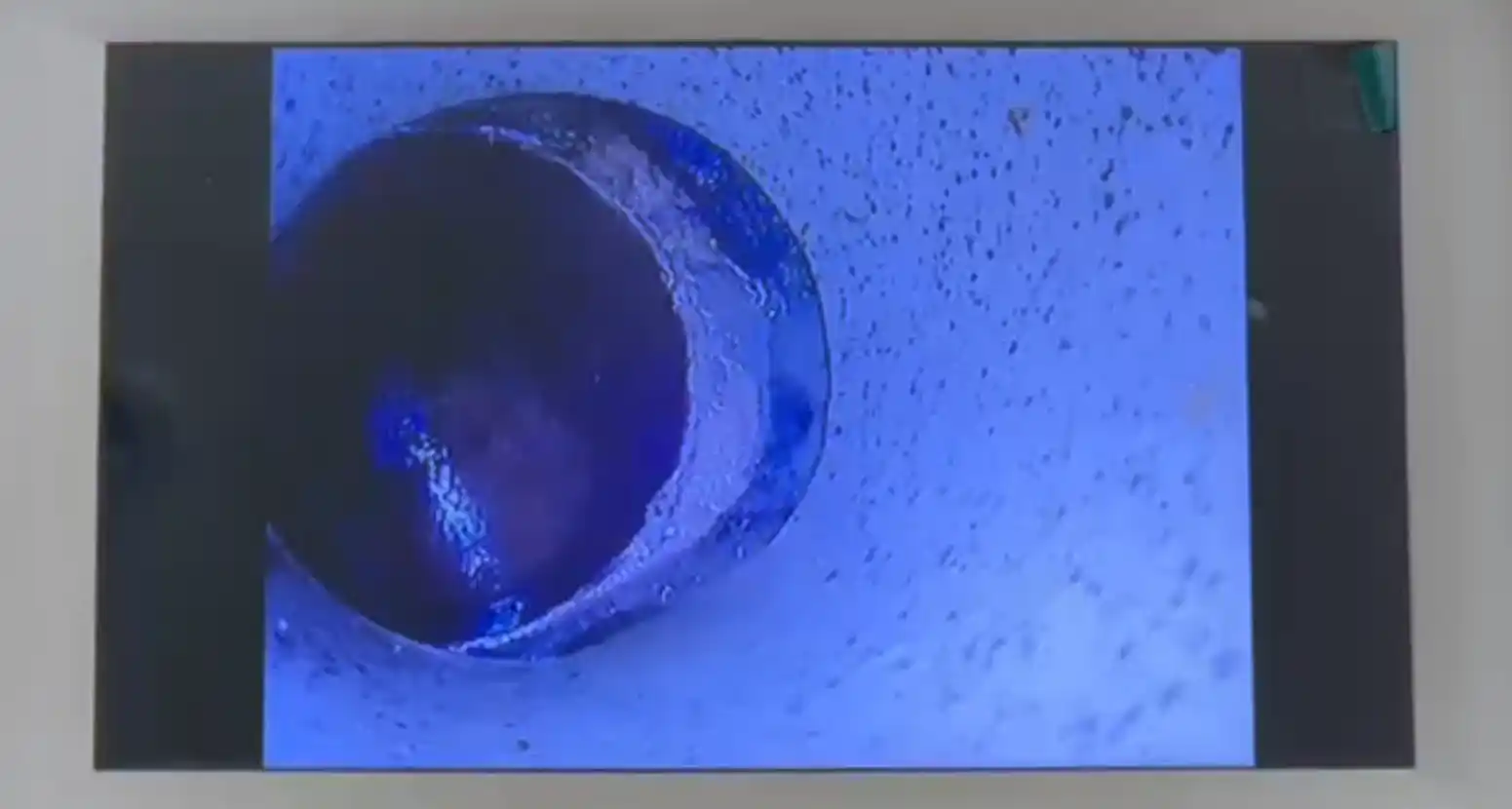

Jet & CCTV every two years – proves “reasonable maintenance” if you end up in a dispute.

-

Keep photos and invoices – insurers love evidence.

-

Document sudden events – date-stamped pictures the moment you spot the collapse.

-

Know your boundary – shared sewers looked after by South West Water aren’t your financial headache.

When Insurance Says No—Your Options

-

Localised patch liner – cost-effective for cracks under 1 m.

-

Full resin re-line – cheaper than excavation for long, offset joints.

-

Sectional dig-and-replace – best when the line has already collapsed or is bellied.

A reputable drainage firm will quote each option so you can weigh repair cost vs. a denied claim.

Final Takeaway

Accidental damage inside your boundary? Likely covered.

Gradual deterioration or blockages from wipes? Your wallet.

The fix: combine regular maintenance with crystal-clear evidence, and you’ll know exactly when to ring the insurer—and when to call the jetter.

Need an Expert Eye on Your Policy Problem?

Drainblock Services has helped dozens of Plymouth, Saltash and Tavistock homeowners navigate claims, supply HD footage for assessors and, where needed, carry out trenchless repairs that keep premiums low.

call usFAQs – Blocked Toilet Help – Questions from Plymouth Locals

Usually, yes—if the pipe sits inside your boundary and the damage was sudden and accidental. Look for the clause titled “accidental damage to underground services.” Gradual wear or existing defects are excluded.

Insurers decline claims caused by long-term wear, fatbergs, wipes, poor maintenance, DIY errors, or issues in shared/public sewers. Anything classed as routine upkeep or outside your legal responsibility is on you.

No. Home-emergency or plumbing-and-drainage riders fund an engineer to unblock or make safe in an emergency, up to a call-out limit. Permanent fixes—such as relining or sectional replacement—still fall under your main policy or your own pocket.

Keep evidence: CCTV footage, jetting receipts, and dated photos of sudden damage. These show the pipe was sound beforehand and that you maintain the system—key proof if the insurer queries “wear and tear.”